Sometimes the cost is calculated incorrectly. This can be fixed.

Here are the three main problems and their solutions:

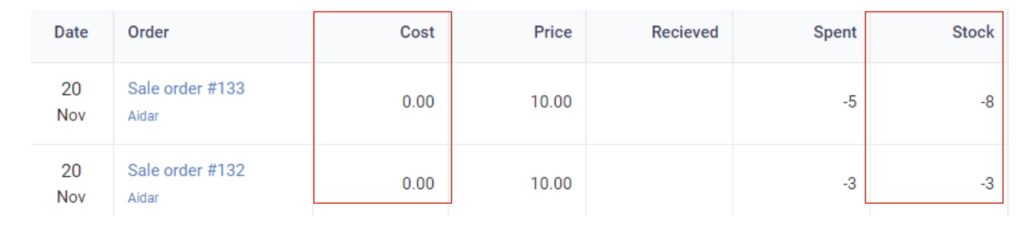

Problem 1. The product has no cost and negative balances.

Reason. The product is not registered.

Decision. Make the registration retroactively.

You go into the reports and see 100% marginality and zero cost. You probably added an item and immediately sold it. In this case, the program did not find out about the initial balances — you did make stock adjustments.

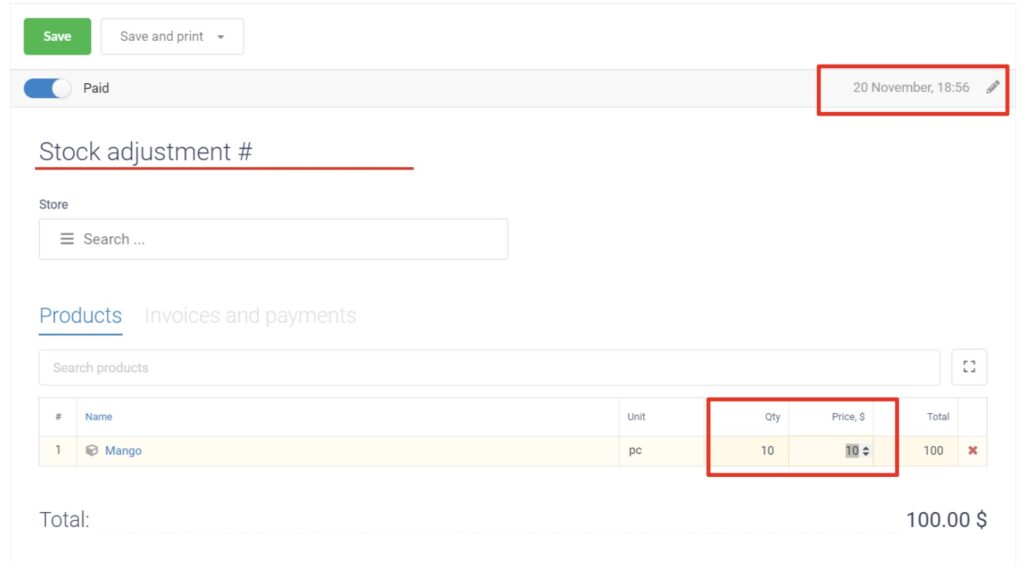

Everything should be in order: first you enter the goods into the warehouse, and then you sell. Click “Create Document” and select “Stock Adjustment”.

Specify the store and change the date. The date must be earlier than the day on which the first sale was carried out: the stock adjustment must be Fullfiled out before the sale. Its date can be seen in the product card in the Inventory History.

Then add the goods to the document and specify the initial quantity, enter the purchase price. After that — “Save”.

You can check the updated cost price in the reports and in the product card.

Problem 2. The product has no cost price, but the stock is correct.

Reason. The product is not registered, but added by correcting the balances.

Decision. Delete the correction and post it retroactively.

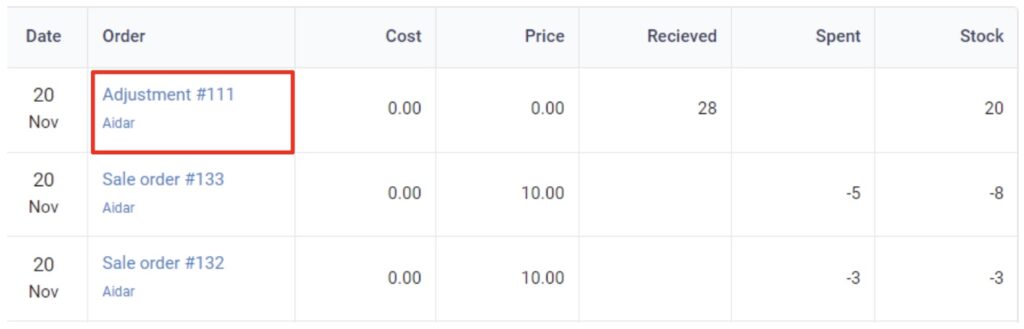

This happens if you adjust the balances directly in the product card. How to fix it? Find the adjustment documents in the card and delete them. Then make the registration retroactively, before sales.

It is done the same way: “Create a document” ⟶ “Stock Adjustment” ⟶ change the date ⟶ add goods, quantity and purchase price ⟶ save.

You can check the updated cost price in the reports and in the product card.

Problem 3. The cost is calculated incorrectly

Reason. The product is first sold, and then registered.

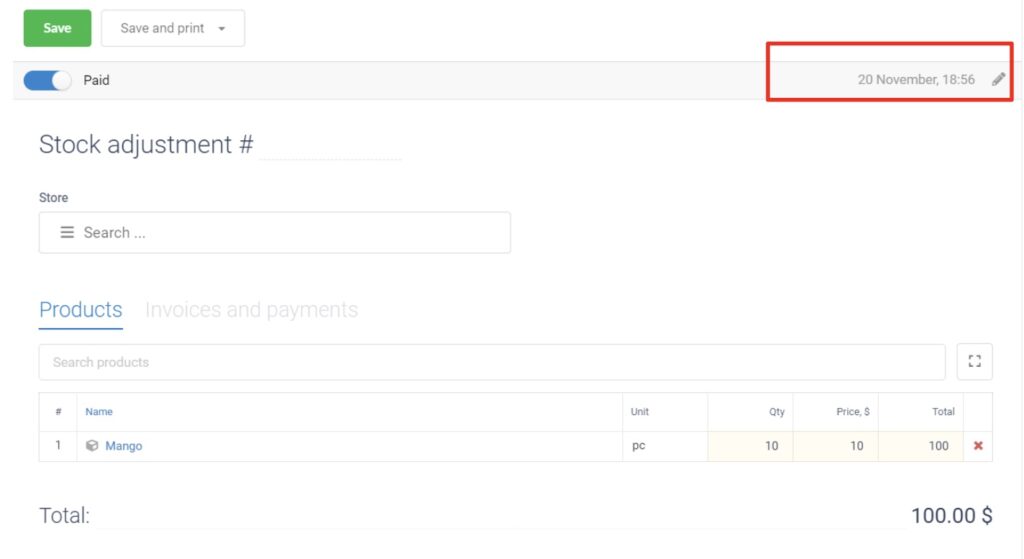

Decision. Change the date in the stock adjustment document.

Check the history in the product card. Everything should be correct there: first stock adjustment, then sales. Wrong? Change the date in the stock adjustment document.

Open to edit and change the date in the upper right corner. The date must be before the sales.

You can check the updated cost price in the reports and in the product card.

Correct calculation of the cost of goods in trade

The cost price will be calculated correctly if you add the goods in the right way.

Immediately add products with quantity and purchase price

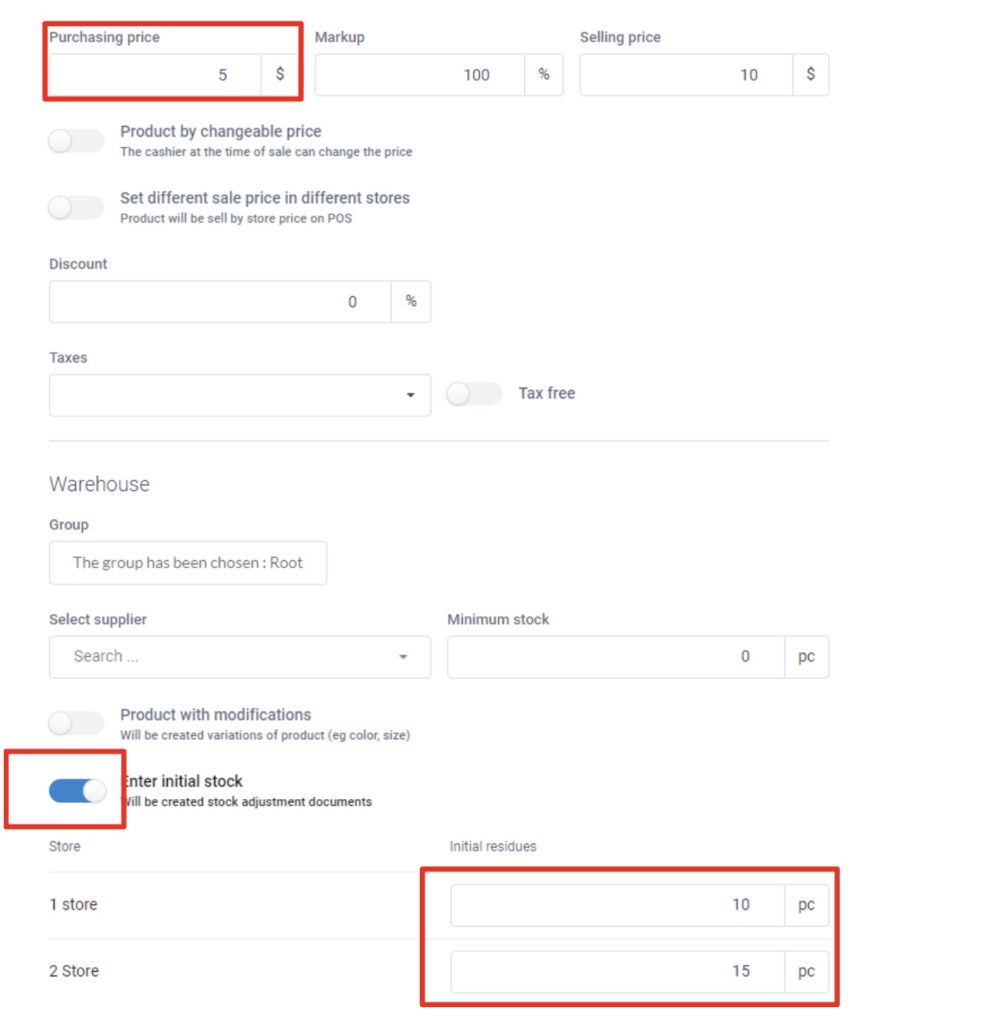

Specify two parameters — the purchase price and the initial balances — right when creating a new product. After saving, the stock adjustment document will be automatically processed and the cost price will be calculated immediately.

First add products, and then stock adjustment.

When adding a new product, it is important to specify only the name. The rest of the data can be specified later. You can creat stock adjustment or purchase goods at any time through the “Create Document” menu.

Important! The date in the purchase and stock adjustment must be earlier than the date of the sales.

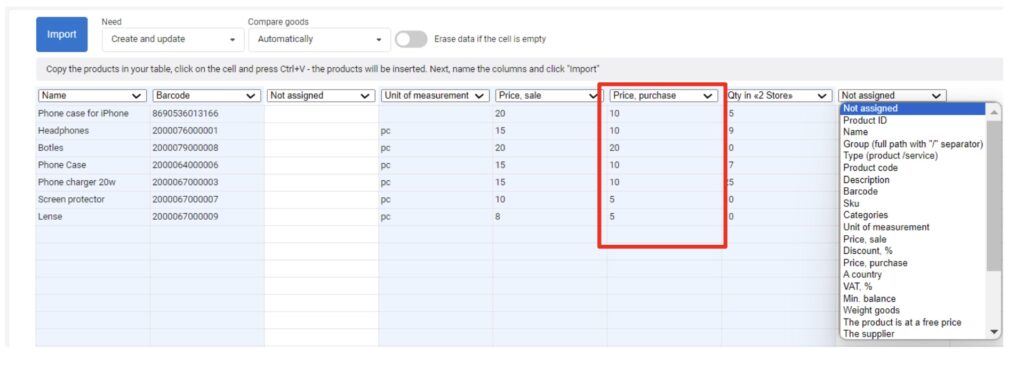

Import goods with a purchase price

When importing several products, you can add columns with the purchase price and the initial balances. At the same time, the goods are accounted for automatically and the cost price is also calculated automatically.

It is easy to keep track of the cost price. It is important to consider three points:

- Create stock adjustment before sales.

- Adjustment doesn’t change the cost.

- You need to add goods only through stock adjustment or purchase.